Self-Driving Trucks: The Future of Logistics Is Already Here For years, the idea of self-driving trucks sounded like something out of a science fiction movie….

trucking wiki

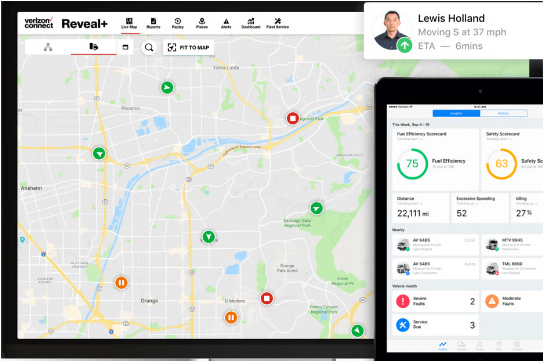

Overview of Tracking Solutions for Semi-Trucks

Semi-truck owners today can choose from a wide range of GPS tracking solutions with dash cams, combining real-time location monitoring with video evidence for safety…

The Trucking Industry Slowdown of 2023-2024

The trucking recession of 2023-2024 had far-reaching consequences beyond the industry. For example, the reduced demand for goods resulted in lower GDP, which led to…

The growth of a dump truck business owned and operated by an individual or a small team can vary widely

The growth of a Dump Truck or End Dump business owned and operated by an individual or a small team can vary widely based on…

Jack Cooper Transport: Trying to Save Yellow Corp, By Buying it

Yellow Corporation, formerly known as YRC Worldwide Inc., is on the brink of liquidation after a significant decline in revenue and crippling debt. Enter Jack…

An investigation is underway to see if a Tennessee Towing Company Illegally Targets Truckers.

An investigation is underway to see if a Tennessee Towing Company Illegally Targets Truckers. As if trucking wasn’t difficult enough, a towing company in Tennessee…

A Change in Joint-Employer Standard Could Impact the Trucking Industry

The National Labor Relations Board (NLRB) recently issued a new joint-employer standard, which could have a significant impact on the trucking sector. This post will…

Yellow Trucking Firm Lays Off 30,000 US Workers

In the latest blow to the US economy, the once-dominant shipping company Yellow has ceased its operations and laid off all 30,000 of its workers….